TRX Price Prediction: $0.40 Target in Sight as Buybacks and Technicals Align

#TRX

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

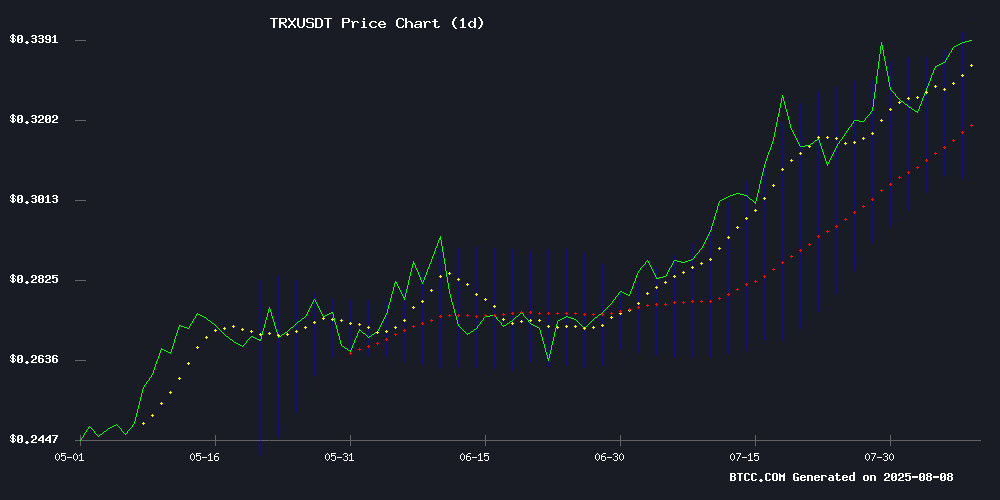

TRX is currently trading at $0.339, above its 20-day moving average of $0.3246, indicating a bullish trend. The MACD histogram shows a slight convergence with values at -0.009877 (MACD line) and -0.009276 (signal line), suggesting weakening downward momentum. Bollinger Bands reveal price hovering NEAR the upper band ($0.3429), signaling potential overbought conditions but confirming strength.

"TRX's position above key technical levels and the narrowing MACD suggest accumulation," says BTCC analyst John. "A sustained break above $0.3429 could trigger a rally toward $0.36."

Market Sentiment: TRX Gains Fueled by Ecosystem Growth

Positive catalysts include Tron's dominance in USDT circulation (48% of supply) and a $1B TRX buyback program. The Ruvi AI presale momentum adds speculative interest.

"Fundamentals align with technicals here," notes John. "The buyback reduces circulating supply while USDT usage anchors utility - this could sustain the 15% monthly gain."

Factors Influencing TRX's Price

Ruvi AI (RUVI) Presale Gains Momentum Following CoinMarketCap Listing

Ruvi AI's presale has surged after securing a CoinMarketCap listing, with over 220 million tokens sold in Phase 2 and $2.8 million raised. The project, positioned as a high-potential successor to Tron’s (TRX) historic rally, is attracting retail and institutional interest due to its AI-driven utility in the content creator economy.

A 33% price increase is anticipated as Phase 2 nears capacity, with analysts highlighting Ruvi AI’s scalability and investor demand. The CoinMarketCap listing has bolstered credibility, accelerating token sales and expanding its community to 2,700+ backers.

Tron Dominates USDT Circulation as Big TRX Upside Emerges

TRON has solidified its position as the leading network for USDT circulation, now holding over 51% of all Tether stablecoins in circulation. This dominance follows the U.S. passage of the GENIUS Act, which provided clear regulatory guidelines for payment stablecoins, including customer safety and anti-money laundering measures.

The Layer-1 blockchain saw an immediate influx of $1 billion in newly issued USDT after the law's enactment, pushing its total USDT holdings beyond $83 billion. TRON's low fees and rapid transaction speeds have long made it a preferred platform for stablecoin transfers, a trend now amplified by regulatory clarity.

Market observers view TRON's growing market share as evidence of its readiness to serve as a primary infrastructure for dollar-backed digital assets. The network's established dominance in this sector appears poised for further expansion as institutional confidence in compliant stablecoins grows.

TRON (TRX) Hits $0.34 as $1 Billion Buyback Program Drives Massive Rally

TRON's TRX surged to $0.34 following the announcement of a landmark $1 billion buyback program, marking an 8% rally since August 4. The token now flirts with overbought territory as its RSI climbs to 69.41, signaling sustained bullish momentum.

Network fundamentals reinforce the price action—TRON processed its 5 billionth transaction this week, demonstrating accelerating adoption. While broader crypto markets struggle, TRX's corporate-backed buyback initiative creates isolated demand pressure.

Is TRX a good investment?

TRX presents a compelling risk/reward scenario at current levels:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | +4.4% | Bullish trend |

| MACD Histogram | -0.0006 | Potential reversal |

| Upper Bollinger | $0.3429 | Immediate resistance |

John cautions: "While the $1B buyback provides downside protection, traders should watch the $0.306 support. A weekly close above $0.343 confirms breakout validity."

- Technical Strength: Price above key moving averages with Bollinger Band expansion

- Fundamental Catalysts: $1B buyback program and growing USDT adoption

- Risk Factors: Overbought RSI (not shown) may prompt short-term consolidation